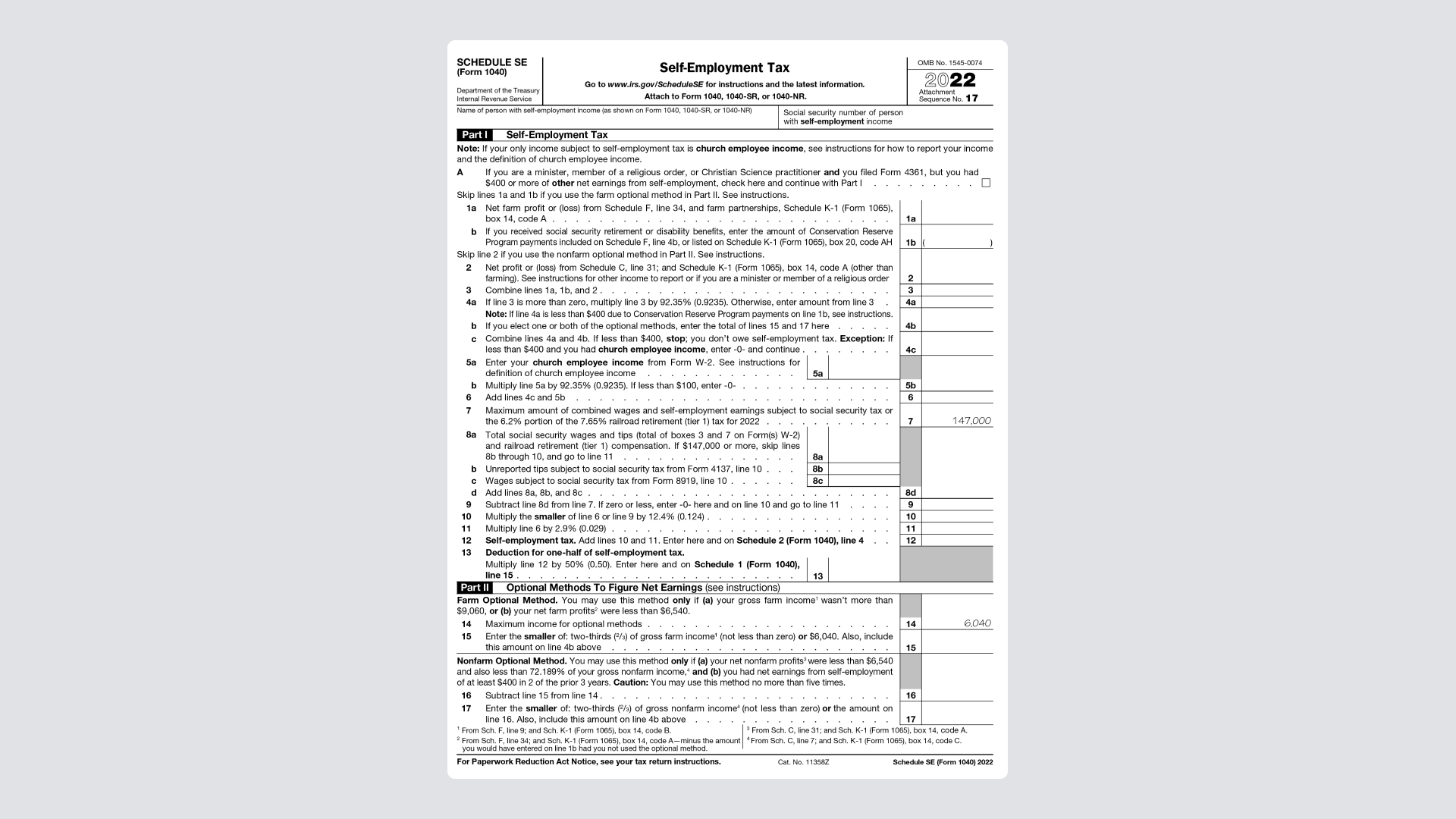

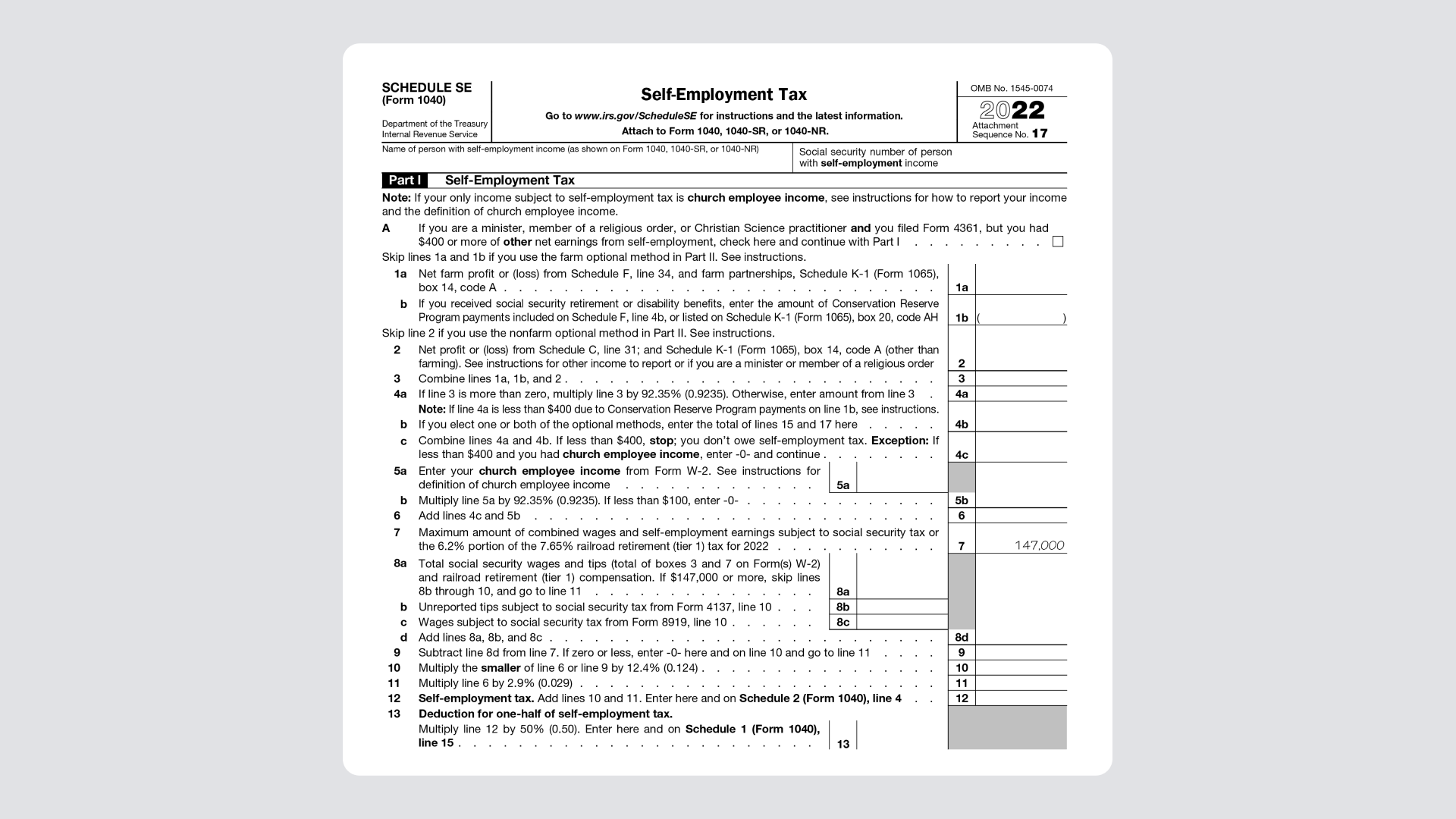

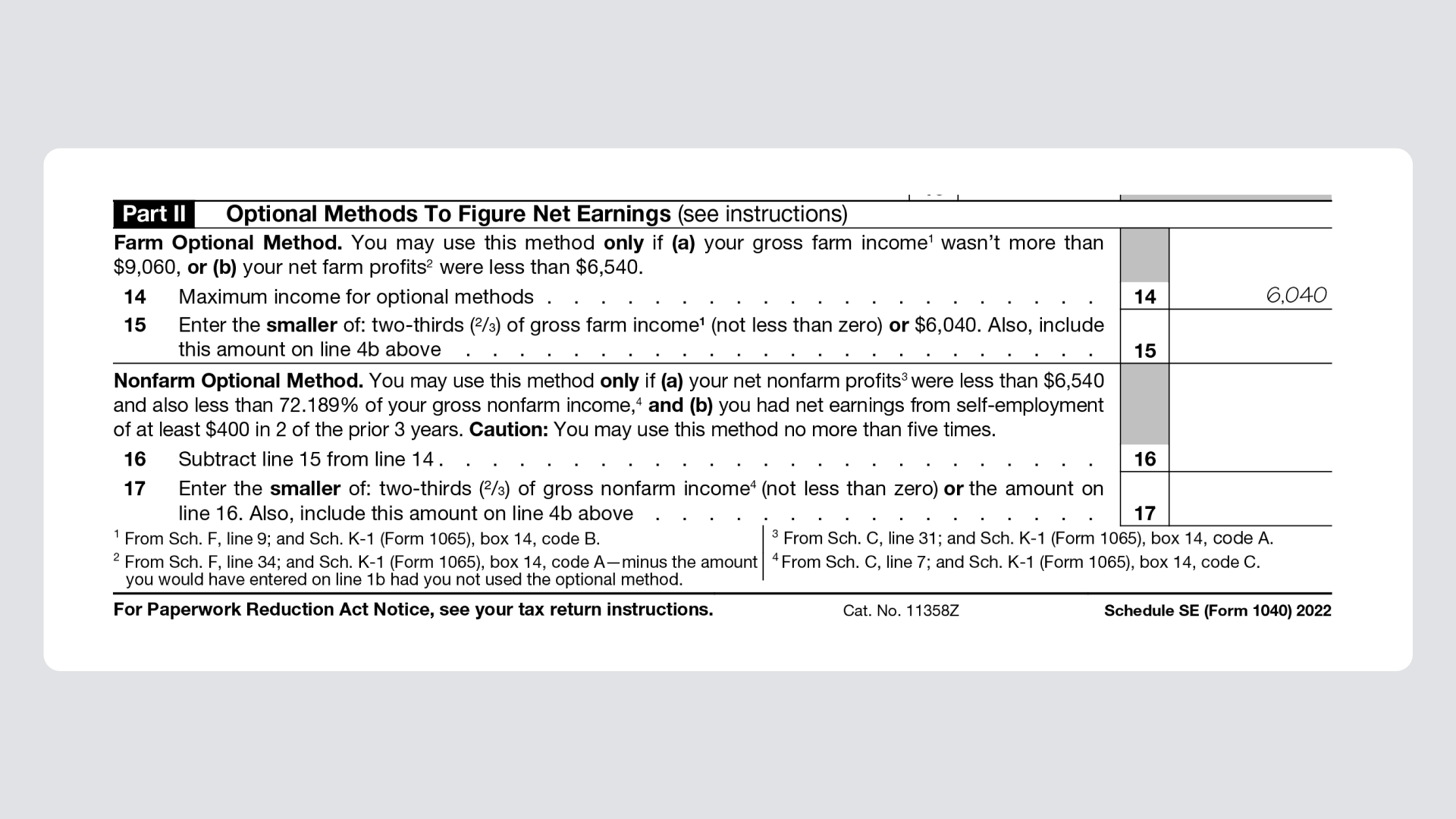

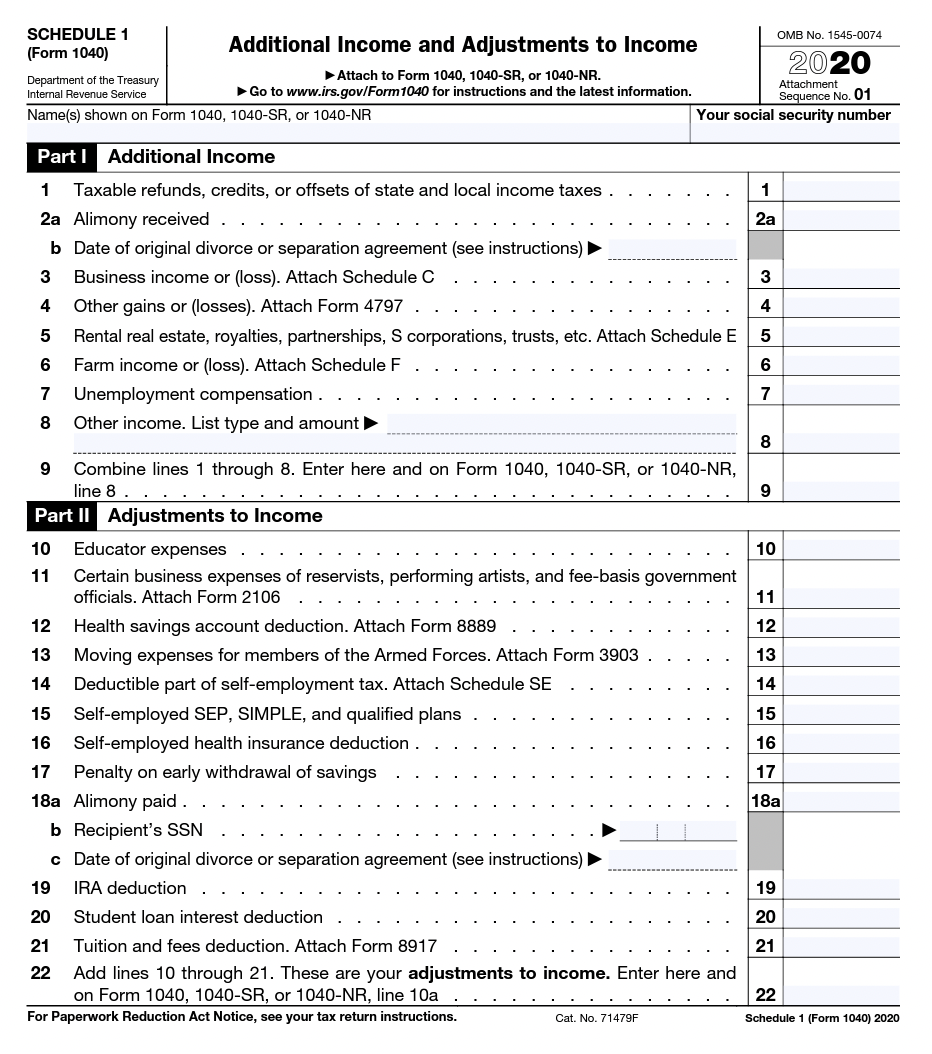

2024 Schedule Se Self Employment Form 1040 – To report your Social Security and Medicare taxes, you must file Schedule SE (Form 1040), Self-Employment Tax. Use the income or loss calculated on Schedule C or Schedule C-EZ to determine the . The dates for the official announcement and application form release, the application deadline, and the exam month are all included in the SSC exam calendar 2024. The SSC exam schedule for 2024–2025 .

2024 Schedule Se Self Employment Form 1040

Source : found.com

All About Self Employment Tax | SmartAsset

Source : smartasset.com

Paying self employment taxes on the revised Schedule SE Don’t

Source : www.dontmesswithtaxes.com

Publication 560 (2022), Retirement Plans for Small Business

Source : www.irs.gov

A Step by Step Guide to the Schedule SE Tax Form

Source : found.com

Self Employment Taxes: What Gig Workers and Freelancers Need to

Source : rcmycpa.com

A Step by Step Guide to the Schedule SE Tax Form

Source : found.com

Most commonly requested tax forms | Tuition | ASU

Source : tuition.asu.edu

How to Pay Less Tax on Self Employment Income — Millennial Money

Source : moneywithkatie.com

5 tax tips for the self employed – Orlando Sentinel

Source : www.orlandosentinel.com

2024 Schedule Se Self Employment Form 1040 A Step by Step Guide to the Schedule SE Tax Form: Schedule C is a form that self-employed people have to file alongside their tax return, or Form 1040. “The difference you also need to fill out Schedule SE to calculate your self-employment . CHAMPAIGN, Ill. (WICS) — The Illinois football team’s 2024 Big Ten schedule was announced Thursday by the conference office. The 2024 season will be the first for the 18-team Big Ten following the .