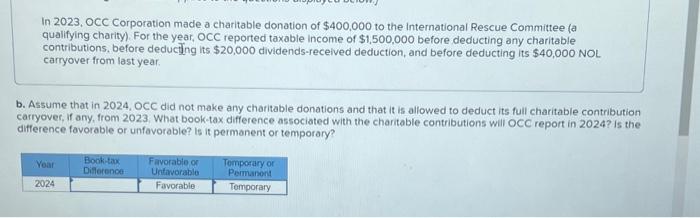

Are Charitable Contributions Deductible On Schedule A In 2024 – The 2023 rules require donors to itemize their deductions to claim any charitable contribution deductions and are limited to the AGI limit of 60% for cash donations for qualified charities. . When filing, individuals or businesses must itemize deductions on Schedule A of IRS Form 1040. Limits apply to charitable contribution deductions based on IRS limits. For 2022 and later .

Are Charitable Contributions Deductible On Schedule A In 2024

Source : www.chegg.com

Small Business Issues, Small Business Ideas; Barbara Weltman

Source : bigideasforsmallbusiness.com

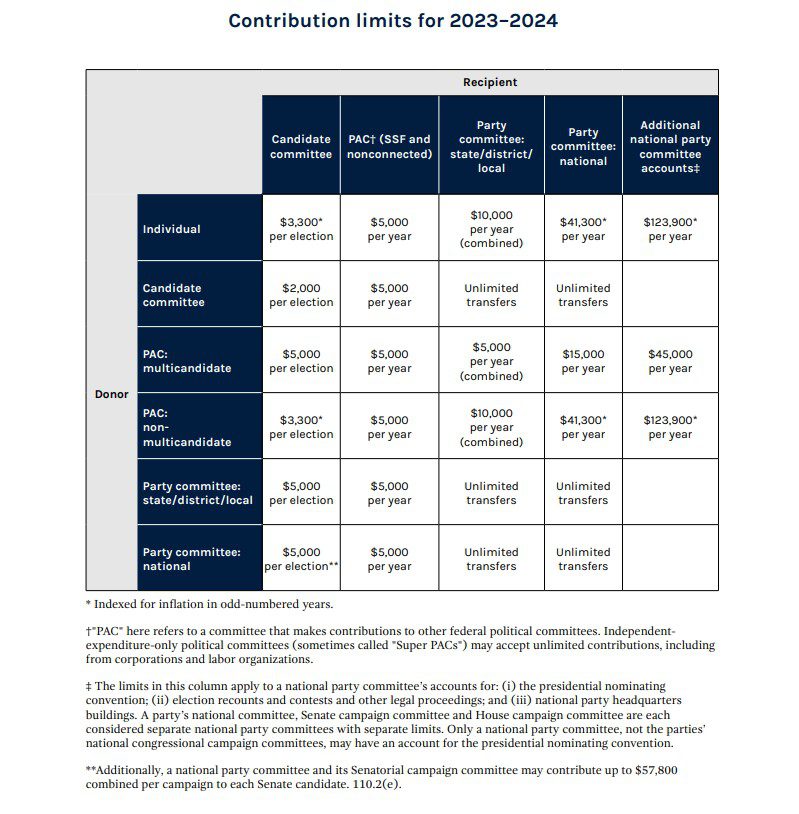

2023 Inflation Adjustments and FEC Contribution Limits Harmon Curran

Source : harmoncurran.com

IRS Sets 2024 Tax Brackets with Inflation Adjustments

Source : www.aarp.org

Wealth Evolution Group | Frisco CO

Source : www.facebook.com

Kris Kamann, CAP® on LinkedIn: S.566 “The Charitable Act”

Source : www.linkedin.com

How did the Tax Cuts and Jobs Act change business taxes? | Tax

Source : www.taxpolicycenter.org

IRS Announces 2024 Tax Brackets, Standard Deductions And Other

Source : www.forbes.com

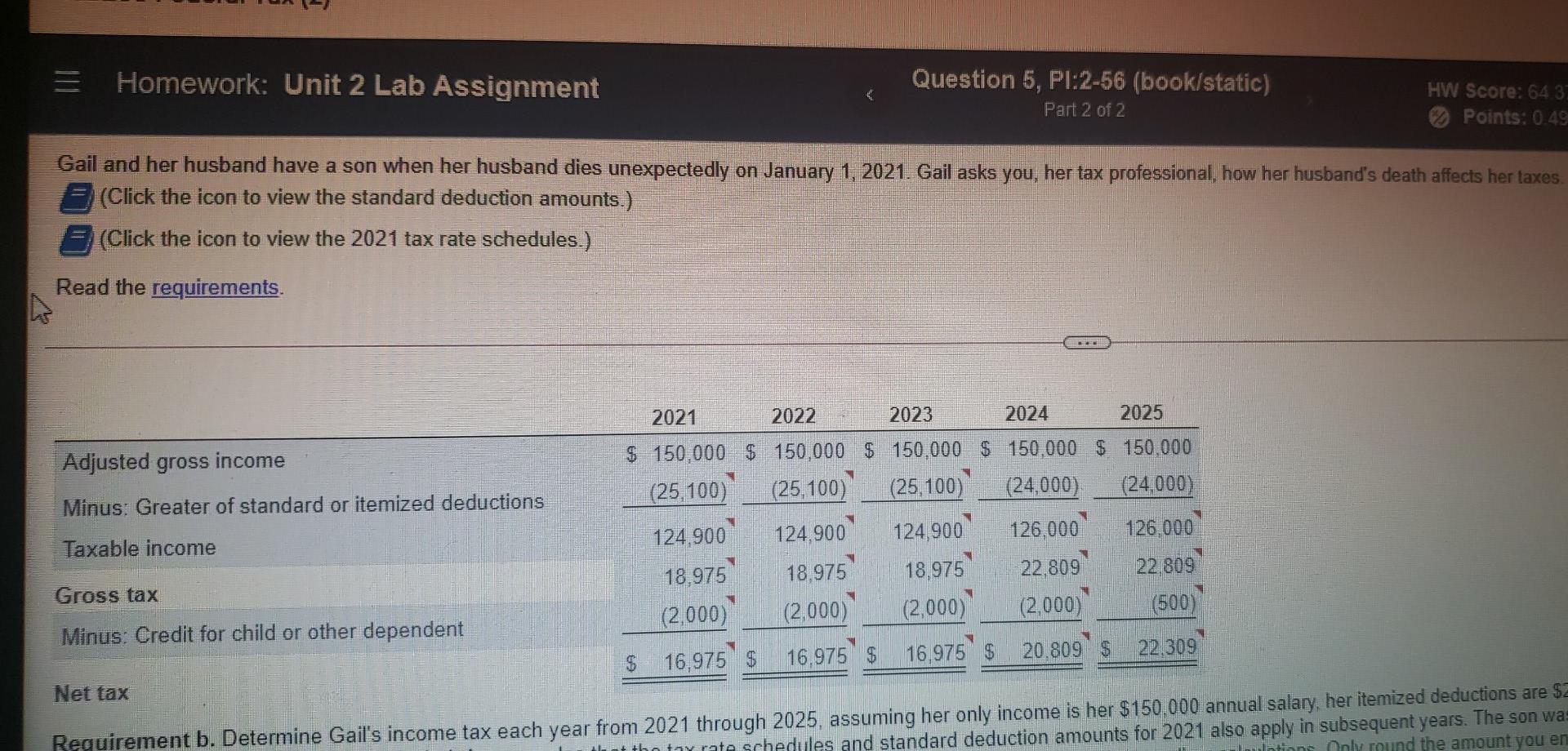

Homework: Unit 2 Lab Assignment * Question 5, | Chegg.com

Source : www.chegg.com

February 3, 2024

Source : secure.everyaction.com

Are Charitable Contributions Deductible On Schedule A In 2024 Solved In 2023, OCC Corporation made a charitable donation | Chegg.com: Donating business assets to charity may allow you to take a charitable contribution corporation — charitable deductions are taken as an itemized deduction on Schedule A. . The IRS has announced the annual inflation adjustments for the year 2024, including tax rate schedules, tax tables and cost-of-living adjustments. .